|

|

|

Op-ed

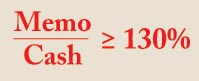

Stall and Spin

By Martin Rapaport

RAPAPORT... About 30 years ago, I learned how to pilot a single-engine aircraft, a Cessna 150 to be exact. One of the most important lessons was how to handle a stall and spin. A stall takes place when the plane heads up too sharply, loses lift from the wings, gets pulled down nose first by the heavy engine and then spins. Not a pleasant experience. You become disoriented as the earth comes rushing up to your face and you think you are going to die. Your natural instinct is to pull back on the wheel and get your nose up. But if you do that, you will certainly crash. The trick to being a good pilot is to control your instincts and deny your vertigo. Push the nose down, go deeper into the dive, straighten out, get lift under your wings and slowly climb out of the dive. When you are out there alone at 8,000 feet practicing your spins, it gets simple. Fight the external forces and you die; go with the flow and you live. While comparisons to the current situation in the diamond industry are obvious, the solutions are less so. What is clear is that the diamond trade can no longer afford disorientation and denial. The impulsive and instinctive industry reaction to protect inventory values at all costs is a sure way to bankruptcy. While there is nothing to stop suicidal firms from self-destructing, one would hope that reasoned minds and rational solutions will prevail. Recognition that survival requires the diamond industry to lower prices to meet demand is a good first step.  What is necessary for the industry is not necessarily the way forward for individual firms. Companies and individuals that have either no debt or enough cash to pay off debt can afford to wait out the difficult market by maintaining high asking prices. Some firms that can afford “not to sell” have been offering goods on memo, at prices some 30 to 35 percent higher than cash transaction prices. This huge spread between memo and cash prices is healthy, justified and necessary as it rewards those who are willing to hold inventory or pay cash for diamonds with significant profit margins. Jewelers should wake up to the fact that if they are not willing to pay cash, they are not entitled to cash prices. The position of companies that are over-inventoried and underfinanced is less flexible. They have to sell. It is not a matter of price, profit or loss; it is a matter of survival. These firms are in desperate need of fair cash markets to sell into. The idea that there is no cash market for diamonds and/or that cash prices need to be hidden to protect the inventory value of sellers is, in my view, false, illegitimate and evil. How can we, as an industry, sell diamonds as a store of value and then refuse to buy them back in troubled times? We must recognize that confidence in diamonds is a direct function of the diamond trade’s ability to turn diamonds into cash. Consumers who have been decimated by the financial crisis cannot be told there is no market for their diamonds. Firms that need to pay their suppliers or banks must have a fair way to sell their inventory. While cash market pricing transparency is a threat to firms that wish to protect inflated inventory valuations and/or charge high prices, it is a vital necessity for the establishment of efficient cash markets and the survival of the diamond industry. The true test of the diamond industry is not how much money we can make during prosperous times, but rather how we handle ourselves in times of crisis. Do we have the integrity, honesty and pricing transparency necessary to support efficient cash markets? Do we provide liquidity to firms and individuals that desperately need cash? Do we stand behind our diamonds? Click here to watch the video of Martin Rapaport's New Year Analysis

Article from the Rapaport Magazine - February 2009. To subscribe click here.

|

Well Done !

|

|

Feb 20, 2009 1:54AM

By Rajender Agarwal

|

Well Done Mr.Rapaport ! Finally , you are getting courage to defy the lobbyists and vested interests and the List is gradually reflecting reality.

Keep it up ! Now, consumers will get fair value for money despite the foolish efforts and greed of manufacturers.

rajender

|

|

|

|

|

Sun Rays

|

|

Feb 4, 2009 4:02AM

By Nishit Mehta

|

|

Mr. Martin: Hats off to you sir. You are the biggest king of solitares. The biggest GAMBLER. Think so you must also be doing polished trading business. Sir You are the only one in the whole diamond market who knows when to hold on stock and when to clear it out. You just have to sit on your chair and change the numbers but its we the people who faces the reality. You are the only man behind this scene.Last year 2008 you had increased the rap only before the DTC sights. We had to purchase the rough with the highest prices.No doubt our stock amount had increased with the rap but the very next site the rough rates had also increased. The same thing you did this year 2009 also. You just decreased the rap just before our parcel got opened and the DTC sight got over. So again the loosers are the Manufacturers and the traders.Now its time for you to understand the people's position and not just be partial on the miner's side. Just try to understand the markets position stop decreasing the rapaport for few months so that the market becomes bit of stable.You stop decreasing the rap and automatically traders will start asking for higher prices.Just try and understand ahe world recession and make the market bit stable.Diamond is forever so just try and make it valuable in this degrading market.

|

|

|

|

|

recept for saving diamonds business.

|

|

Feb 2, 2009 7:15AM

By Alexandrs Antipovs

|

Dear Sirs!

Dear Mr. Rapaport!

Maybe my opinion don’t interesting such a lot of people because I am not a diamond miner, and I don’t have cut manufacturing. I just sell not big quantity diamonds in my market. Mr. Rapaport, You right conducted analogy with flying planes, the most important in fly – it is the orientation is in space – line of horizon. Last years like that line in diamonds business was RDR, hope that like that horizon it will stay. It is necessary to do justice all diamanters, that in last years prices for diamonds didn’t repeat high flights and falling prices of gold, like it was in 80th years.

If in extent of last 30 years, RDR was voice of selling diamonds on exchange for us, and inform all sellers about prices, today it is necessary to help RDR, ourselves, and our buyers to fix prices at that current moment and freeze them for the nearest 3 years, maybe more. All discounts and bonuses count from that day prices.

Why it need? For that, that we will designate OUR horizon. If we will swim by the flow, we will not change from (for example): bananas seller. Don’t forget – we sell exclusive commodity, in buying which aim a lot of people. For another example: You won’t sell Picasso picture by 100$, if pictures price is 1 million $. Sure, you may sell it by 100$, if there is nothing to eat, but the price for it is another.

Gold and diamonds – there are equivalent of money. Only gold gave on the torment for exchanges brokers, which trade by “air”, diamonds avoid that fate.

Mr. Rapaport, You united a huge army of sellers, peoples who cut diamonds, and for them for whom diamonds are not indifferent. Conduct questioning about freezing price, if in one week for that questioning answer 40% of members and 50%+ 1 vote from them will be FOR freezing price, please make accordance steps. You may make voting on your web site, that all can see results.

Our business in our hands, accountable to each other, and before our buyers, we should not destroy standard of beauty, happiness, wishes, love and cleanness.

Yours sincerely

Antipovs Alexandrs

id: 55560

|

|

|

|

|

|

|

Jan 31, 2009 4:20PM

By Anup Jogani

|

|

Diamonds are an emotional purchase first and foremost. We must learn to keep the right merchandise for our "customers" and simply not the goods that can travel from dealer to dealer. If the right diamond exists at the right price for the right call, jewelers must buy and pay a profit, even in todays market. Prices should be attractive enough to reward the cash buyer and memo buyers should relegate themselves to much smaller margins because they have not established a serious qualified call that is a 99% sale.

|

|

|

|

|

leave it alone

|

|

Jan 30, 2009 8:19AM

By michael indelicato

|

|

there was buisiness being done we were up last year and dec down a little and jan the same as last year the strong will survive and the the weak will go so all in all we were fine but now with the list going down and who knows when again it starts to make you wonder why buy and lose money we are one of those cash rich companys that everyone talks about will do fine in these times and have not stopped buying but even companys like us now have to be more selective in what we purchase almost like going through a mine field hopeing your buying the rite item and i believe its companys like us who have help keep what buisnes there is left for our suppliers untill now. we have the customers and the staff but now there is going to be iam sure a wait and see kind of aproach which we can not control lets hope for the best

|

|

|

|

|

Its time to get real

|

|

Jan 30, 2009 1:45AM

By rajeev shah

|

Well done, Martin !Finally , you have shaken off the pressures of the manufacturers who made huge profits for the last 4 years - and now when they see the cycle turn have started screaming from the rooftops.

Why not maintain Gold Prices @ $1000, Silver @ $22 and let the buyers decide the prices they want to trade.

The biggest problem of our trade is lack of transparency - and its a crying shame that the members want to create an invisible cartel and artificial prices.

You are being kind by holding the prices for the last 4 weeks - BUT TRUTH WILL OUT !

Most diamantaires , who have invested their funds in the business will suffer losses that will eat away only part of the SUPRA profits they earned in the last 4 years ; its only the speculators who took money out of the biz and played the oil/forex/metals/share market - incl diversion of bank funds are facing a crisis of survival and I am sure the List will not play into their hands.

You have WALKED THE TALK as one of the comments suggested, its time you are more aggresively in line with the true market prices.

|

|

|

|

|

Price List

|

|

Jan 30, 2009 1:09AM

By MJL

|

|

Mr Rapaport, why even bother the little amount you lowered the price list today. a good starting point should have been 10% reduction across the board and that would have woke up those dealers who are in denial about lowering prices and then you made a strong statement and not have worry about lowering prices for a long while.

|

|

|

|

|

Larger discounts

|

|

Jan 29, 2009 8:01PM

By jeff josephson

|

The market is finding itself, we find that diamonds can be sold for cash, its only that the sellers have to decide whether or not to accept the large discounts they need to accept in order to sell the stone.

The list is only an indicator of current market, 6 months ago I would have needed to pay 25% more for a stone than I have to pay now...cash buyers are out there for the right price .

|

|

|

|

|

sometimes you just cannot fly any longer

|

|

Jan 29, 2009 6:32PM

By Isaac Mostovicz

|

It is nice to draw analogies but they do not work. in this case, what do you do when there is no air left to lift you up or that you are too close to ground? That is unfortunately the case with the diamond trade when there is no cash left and many companies are de-facto bankrupt.

slashing prices won't help either. It is a well known phenomenon in luxury that when prices go below a certain level demand shrinks. Lower your prices and you will send away the few who are still willing to buy a diamond.

It seems that we are dealing with an autistic industry that is totally disconnected from the reality out there. Sorry friends, but the real market and the real consumer market is not running by your "theories" that no serious expert will buy because of the mounting evidence that just tells the opposite.

If you really want to start doing something that works, start to examine your consumer base.

Dr. Isaac Mostovicz

Chairman

Janus Thinking LTD

isaac@janusthinking.com

|

|

|

|

|

THE REAL DIAMOND VALUE

|

|

Jan 29, 2009 4:10PM

By A Singer

|

Dear Mr. Rapaport;

You are very right but you will still agree on a few points.

1) That you cannot base the real value of a diamond according to the price it has been sold by a few distressed people or liqudating companies, but according to the average cash price purchased and sold by regular means of business, which is still only a few percent less than sold for terms.

2) That your list is not refelecting the cash price at all, but it's reflecting only as a starting point for every buyer and seller to discount according to his needs and requirements, which is fluctuating naturally from stone to stone and from deal to deal, The discount for a distressed seller of a 5 ct. D FL will not be the same as a regular seller of a 1 ct. F SI1 for acceptable 60 days terms, so that means that your list is not reflecting the real value of the diamonds whatsever, and that your list is not protecting the consumer cash sellers either.

SO WHY NOT LEAVE YOUR LIST ALONE, AND LET THE MARKET OF BUYERS AND SELLERS DECIDE WHAT VALUE EACH DIAMOND HAS TO HIM ACCORDING TO HIS PERSONAL TERMS AND CONDITIONS.

INSTEAD OF CREATING A PANICK AND RUMOR OF FALLING DIAMOND PRICES BY THE PRIVATE CONSUMERS WHO DON'T KNOW THE SECRET THAT YOUR PRICLE LIST IS NOT THE REAL VALUE OF THEIR DIAMONDS ANYWAYS.

|

|

|

|

|

Diamonds are special

|

|

Jan 29, 2009 2:30PM

By Dave Atlas

|

With all the money being pumped into the free markets and by governmental central banks around the world, we will eventually have some very intense inflationary forces in place. All things being equal, we should expect diamonds to rise in value along with falling currency values. This sounds logical, but it may not happen due to loss of demand.

Of course, diamonds are not so useful as they are well promoted and marketed. Gold can be bought and sold for immediate cash much more easily. Gold is likely to immediately reflect the market conditions whereas diamond dealers often keep their heads buried in their valuts. Diamonds take substantial expertise in buying and cashing them out is not always a smple or rapid task. Consumers could, if they get pinched a lot more, just change their minds about what is important to them and pretty much stop buying diamonds for a period of time. It could be years, not months, for them to regain the desire for diamonds. DeBeers and others may slow promoting them even more and this will further lead to a decreased volume of business. The diamond business is poised for a big hit as consumers are changing their buying habits.

Get yourself cash rich and control your inventory and the risks you accept with customers. Buy only on opportunity when bargains are ready to be had and hold off otherwise. Some of the biggest chains and famous name firms are going to go broke in these markets. Being careful today is smart business.

Buyng and selling diamonds for TODAY'S realistic value is far more sensible than sitting on them in hopes of some future recovery with no date certain. When you sell, you replace them with less costly diamonds based on the today's realistically lower costs (value). Then you can begin to make a profit, but losses will come first on old inventory. There is no way around it. The Rap Sheet ought to reflect honesty in its prices today and always. It may be painful to see prices lowered, but accuracy is why the Sheet exists and has been accepted & useful. Sure, it is a love-hate thing, but when things decline, the sheet ought to report it, just as things go up it ought to be reported.

|

|

|

|

|

sales are happening

|

|

Jan 29, 2009 1:28PM

By michael Indelicato

|

|

we have been selling 3-4ct stones to our surprize and i think thats because they are great deals out there and orders are picking up and to have the list go down now i think as many do would strip all that away

|

|

|

|

|

price list??

|

|

Jan 29, 2009 1:27PM

By sahil chodhari

|

|

I still remember very well what Mr Martin said not too long ago,that when the music stops,you need a chair. The only question is when will the music stop??what i am asking is when will Martin give us an indication that rap prices will remain steady,which they should.And if you DO want to decrease the list,then do it now,so that we can adjust to the changing climate.With the world economy still in recession,i'm sure that Martin will decrease the list very soon.The only question is when and not if the list will decrease as i think.

|

|

|

|

|

Any reduction in rap will put customers away

|

|

Jan 29, 2009 1:19PM

By tanmay shah -khushi diamonds

|

|

please try to understand that by reduction in rap prices weakens the confidence of the trader and hence the customer .people with cash are the smarter lot ...will not make any hasty decision to purchase and will wait and watch till there is any stability .by constantly reducing prices ,will dent their confidence and will not serve the purpose of selling diamonds which you and industry both want .your rap which we greatly respect ,is the only baromter for the customer to judge the price of this luxury product and hence its stabilty is of prime importance .surely customers are price conscious ,but at the sametime they are more. Worried this time whether diamond as product will hold any value in longer run .nobody wants to put money in stocks ,realestate since its value cannot be controlled ...diamonds have a chance against all other commodities , if we as a industry play our cards well

|

|

|

|

|

freeze the list to create liqudity

|

|

Jan 29, 2009 12:39PM

By jhaveri s dajhaveri@dajhaveri.com

|

|

the rap list is the face of the diamond indusry ,if it keeps on falling or if it creates a fear of further fall there is never goin to be a real sale goods wiil be sent out on memo as the buyer wont have the strenth to buy goods .....to stop the indusry from fallin more we need to stabalise the price list for a long time let the sellers decide the discouts according to their need for liqudity, sooner or later the discouts will stabalise and good will be sold and there will be liqudity in the market.if the list keeps on changing there wont be sale and no liqidity.the indusry is ready to sell diamonds at a cheaper price but because of the fear of the list going down there are no buyers .....so pls guide us how do we create liqudty sice the buyers are scared of ur list why dont you freeze the list for 3months and the see how the markets react.

|

|

|

|

|

Integrity...Honesty....et al

|

|

Jan 29, 2009 12:19PM

By dharmesh bothra

|

Dear Martin,

I like to read the words "integrity,honesty,transparency...." in your article. And the words spoken will stand their own test, when the Price List reflects the truth ....and the truth is that the prices have fallen and are falling.

The average discount on the List is now truly over 40% to start a biz conversation, and therefore the List must reflect the lower prices.

Most of the comments against the List reflecting the truth are probably from manufacturers, who are now losing money from old Inventory. None of them ever commented when the List was being marked up and at tremendous speed.

The price at which roughs are now available, will ensure that the COST for the Polished goods will be at 60-65% discount to current prices. Therefore, reason enuf for New,Lower Prices - to emulate your words..."Honesty,Pricing Transparency, Integrity" WALK THE TALK ,Martin.

|

|

|

|

|

stall and spin

|

|

Jan 29, 2009 11:08AM

By Steve Pheng

|

housing goes down, stock market goes does, oil prices go down, sales go down, unemployment goes up, bankruptcies goes up and so on and so on!!!

why shouldn't diamond prices fall??? are diamonds immune to the world financial crises??? diamond prices should adjust to the economic reality.

steve pheng

intagems

|

|

|

|

|

"YOU THE PILOT"

|

|

Jan 29, 2009 7:30AM

By Kapu Gems

|

THATS A BEAUTIFUL EXAMPLE YOU GAVE OF THE PLANE.BUT HERE IT IS NECESSARY FOR THE WHOLE DIAMOND INDUSTRY TO UNDERSTAND ALONG WITH YOU THAT YOU ARE THE PILOT OFF THIS PLANE THAT IS UNDER IMMENSE DIFFICULTY.AND WE ALL AS THE INDUSTRY ARE ASSURED THAT YOU WILL HANDLE THE PLANE WELL THIS TIME AND GIVE IT A SMOOTH LIFT BY NOT EXPERIMENTING THE PRICES.SINCE LAST 3WEEKS WE ARE NOTICING THAT THE MARKETS HAS OPENED UP A LITTLE BIT.WE HAVE STARTED RECIEVING DEMANDS AND SELLING TOO BECAUSE THE RAP IS FURTHER NOT GOING DOWN.PEOPLE GET CONFIDENCE IN PRICE THE SELL WILL COME.ANY CHANGES IN RAP NOW WOULD MEAN THE PLANE AND THE INDUSTRY BOTH WOULD CRASH.AND ALSO LET THE MARKET GET BETTER BY ADJUSTING ITS DISCOUNT.

From :- Kapu gems

Mr Kalpesh

+91 22 43112233

www.kapugems.com

|

|

|

|

|

let the market flow by its own

|

|

Jan 29, 2009 5:43AM

By ashish shah

|

the days ahead are looking better atleast the customer from india are building confidence and trying to invest in diamond . The idea is to take chance because they are cash rich.

An alternation in the price list may result in loosing confidence in customer again. let the market flow be its own .

|

|

|

|

|

By: michael lippman , 1/28/2009

|

|

Jan 29, 2009 1:35AM

By barry

|

|

youre a real jerk and musst work for zales

|

|

|

|

|

Commodity???

|

|

Jan 29, 2009 1:09AM

By Eli Kaufman

|

It's time for all of you to realize that diamonds are not a commodity anymore, but a luxury and consumer items as Prada bags or Armani suits are, hence the

Does a Prada shop refund bags of poeple in the need?

Wake up.

Eli Kaufman.

|

|

|

|

|

MONKEYS GATHERING

|

|

Jan 29, 2009 1:03AM

By RAJ DHOLAKIA

|

|

The reason y the diamond market is in great risk is not the world wide market crisis/recession , its the market itself, . There was a monkey who fell down from a tree and got just a slight bruise, the fellows monkeys ran over to him and started touching the bruise to see how much was the damage , and the result was the bruise became 5 times larger than it was before . The same way we all are the monkeys making the 10% fallen market to 40% by doing meetings ,rapp change, . Let the bruise be how it is, it will just take few time to be normal as it was before, left will just a mark of a bruise.

|

|

|

|

|

ANALYSIS OF ARTICLE

|

|

Jan 28, 2009 10:10PM

By NAVID RABBANIAN

|

|

MR. RAPAPORT WANTS TO WARN US AND ALSO CONVINCE US ITS OKAY FOR HIM TO BECOME A CONDUIT OF DISTRESSED GOODS INTO THE DIAMOND PIPELINE WHICH WILL CAUSE PRICES TO FURTHER DECLINE.

|

|

|

|

|

Let the discounts adjust by themselves

|

|

Jan 28, 2009 6:26PM

By marvin elefant

|

|

By lowering the list you are punishing the buyers and rewarding the memo takers. People will not buy for fear that the list will go down again. The large discrepency between buying price and memo price will slowly diminish in a healthy way as business gets better. The lowering of the list will not stop companies that were unhealthy all along from going bankrupt. Please give this your consideration before you reduce the equity of the stronger companies and when business returns you will already have created the damage.

|

|

|

|

|

MORE CALLS ARE HERE

|

|

Jan 28, 2009 5:24PM

By LEIBISH HOROWITZ

|

|

MR. RAPAPPORT; AS I SEE TH MARKET THERE ARE MORE CALLS COMMING IN IN THE LAST 3 WEEKS, AND THINGS ARE STARTING TO MOVE A BIT. IT IS ONLY THE FEAR FROM THE CONSUMERS SIDE THAT WAS HASITATING TO COME OUT AND BUY. IF YOU WOULDN'T LOWER THE THE PRICES A SCENOD TIME ONLY ONCE THE SEASON WOULD OF BEEN MUCH MORE SUCCESFULL TO ALOT OF DEALERS. IF YOU WILL LEAVE THE LIST THE WAY IT IS NOW FOR ANOTHER PERIOD OF TIME YOU WILL SEE MORE ACTION AND THING WILL START TO STABELIZE IN A MUCH SUCCESFULL WAY, RATHER THEN LOWERING IT ANOTHER TIME AND CLOSE THE MARKET FOR ANOTHER PERIOD OF TIME, AND MAYBE A LONGER TIME. BECAUSE PEOPLE WILL ALLWAYS HAVE THE FEAR THAT IT WILL BECOME WORSE AND WORSE. GIVE IT ANOTHER CHNACE. THE DIFFERENCE BETWEEN THE LAST FEW WEEKS AND BEFORE IS VERY OBVIOUS. TRULY THING ARE HAPPENING CALLS ARE STARTING TO COME IN.

|

|

|

|

|

prepration for list decrease

|

|

Jan 28, 2009 5:01PM

By haim aharonoff

|

time will tell if it will save the inds or another shrinkage &

more bankrupcy till the globle problem will settle.

haim

|

|

|

|

|

stal and spin

|

|

Jan 28, 2009 4:45PM

By michael lippman

|

|

I hope this friday january 30th you start lowering the price list and keep lowering until dealers understand that diamonds are not moving and things will get worse if they dont start asking prices at larger discounts and not over list prices.

|

|

|

|

|

Diamond Cash Market?

|

|

Jan 28, 2009 3:47PM

By Ely Rosenfeld Aura International Inc.

|

Yes Mr. Rapaport;

There is a lively cash market out there. The buyers are coming out slowly but surely. And things are starting to move. The frozen markets are starting to thaw.

Now back to your article.

So you want to bring to the diamond market "mark to market valuation" that is being given credit for a major part of the destruction of our financial system as we know it?

And how large is the "cash market" for diamonds? Isn't most of the market made up of memo goods no matter if you like it or not? And it is based on the "Rap Sheet".

Yes we have Rapaport to give us an indication of prices of prices, but it isn't the Dow Jones!

Yes! Every diamond is different. A .75 trades for more than a .70, and a 1.02 for more than a 1.00. So you can't micromanage the diamond market even though you've been trying for a long time.

It's easy to start on the slippery slope down, but the way up is harder. Let the market find it's own level, as it has started to do on it's own. There are buyers out there. And action begets action. The only way the market can stabilize is when buyers won't feel that the rug will be pulled out from under them.

Eventually the panic selling will stop and we will recover.

Ely Rosenfeld

Aura International Inc.

580 5th Avenue

New York, N.Y. 10036

Tel: 800-435-2872

Tel: 212-944-8491

Fax: 212-944-8492

Email: aurely@thejnet.com

|

|

|

|

|

|

|

|