RAPAPORT...

In a recent conversation with Kent Wong,Chinese super-retailer Chow Tai Fook’s

managing director, Martin Rapaport discussed the future expansion of the company

and the future of diamond sales in China.

|

Kent Wong, managing director of Chow Tai Fook.

Photos courtesy of Chow Tai Fook.

|

MARTIN RAPAPORT: How extensive are Chow Tai Fook’s diamond

operations?

KENT WONG: Chow Tai Fook is a vertically integrated jewelry

retailer that is active in all aspects of the diamond and jewelry supply chain.

We source rough diamonds directly from the De Beers Diamond Trading Company

(DTC), produce polished diamonds in our own diamond-cutting factories, design

and manufacture jewelry for sale in our retail outlets. The broad range of our

activities provides us with first-hand knowledge of the diamond market as we

directly experience how supply and demand dynamics impact our businesses.

MR: What is your view of the diamond market?

KW: We expect the supply of diamonds to grow at moderate

single-digit rates over the next ten years. While the market for the most

expensive diamonds is relatively stable, there is a huge market for

medium-quality diamonds in China. Demand for mid-quality — H to K color, VS to

SI — diamonds over the next three to five years will be very strong, creating a

significant imbalance between supply and demand. We expect the demand for

mid-quality diamonds to grow by about 30 percent per year and anticipate a

shortage of goods in this range.

MR: How about smaller, lower-quality diamonds?

KW: Jewelry with smaller melee diamonds with retail prices

up to $500* provides an excellent sales opportunity in China. We have a project

with the Rio Tinto mining company that promotes Argyle Champagne colored

diamonds that are smaller than 1 point in size. Sales of this fashionable

jewelry with contemporary designs much exceeded our expectations. With the

right products and marketing story, this is another segment we can explore and

develop.

MR: What is your view regarding diamond prices?

KW: During the first half of 2011, diamond prices rose

sharply due to strong demand and expectations that prices would continue to

rise. Overall sales in the industry during the second half of 2011 were below

expectations, resulting in excess inventory and lower prices. As demand

develops in 2012 and inventories rebalance, we expect relatively stable prices

for the next few months. We would like to see diamond prices aligned with

inflation and growing at a healthy 3 percent to 5 percent rate over the next

few years. We are, however, aware that demand for medium-quality diamonds could

outpace supply and this may result in upward price pressure on these particular

qualities.

MR: Why are all of Chow Tai Fook’s jewelry stores and sales

in China, Macau and Hong Kong? Will you be expanding to other markets?

KW: We will continue to concentrate ourselves in the Greater

China region over the next decade because we believe that the jewelry market in

China is just beginning to take off. There are a lot of opportunities for us to

improve our sales performance in this region. Chow Tai Fook has the largest

penetration rate in China with nearly 1,600 points of sale (POS) in more than

320 cities. This concentrated focus has enabled us to firmly establish our

brand and become one of the fastest-growing companies in China.

MR: How important are diamonds in your sales mix and what

are your expectations for the growth of diamond demand in China?

KW: While gold is our most important jewelry category,

representing about 55 percent of sales, we see great opportunities for

diamonds. Gem-set jewelry — mainly with diamonds — accounts for about 24

percent of our sales and this category grew by 60 percent from the first half

of 2010 to the first half of 2011. This strong performance reflects the

expansion of China’s middle class, with increasing diamond demand by consumers

in the 30- to 40-year-old age group. The growth in diamond jewelry demand is

not only taking place in the important bridal engagement ring category, but

also in contemporary diamond jewelry that is well designed for the Chinese buyers.

Young and middle-aged Chinese consumers are buying contemporary diamond jewelry

to celebrate their personal achievements and accomplishments. Diamonds are

becoming an acceptable way for Chinese women to communicate their success and

status.

|

Achievement Collection ring.

|

The Chinese government’s new five-year national economic

plan will seek to expand China’s gross domestic product (GDP) through domestic

consumption. Government policies will support the further development of

middle-class consumer spending. Urbanization policies will expand the economic

base in Tier III and Tier IV cities as rural areas and farmlands are

transformed into urban areas that will include shopping centers and department

stores.

For all of the above reasons, we expect Chinese demand for

popular diamond categories to grow by as much as 30 percent annually over the

next five years.

MR: How important is the Chinese diamond engagement ring

market?

KW: The 13 million marriages in China every year present us

with a great opportunity to increase diamond sales. We believe that about 50

percent of these weddings can or would include a diamond engagement ring. A

small 15-point ring sells at retail for about $500, with average-size 30-point

rings going for about $1,500 to $3,000. Wealthier consumers would be buying 1-carat-and-larger

rings for $10,000 and up.

MR: How important are diamond certificates and grading

reports?

KW: By law, all diamond sales in China must be accompanied

by a diamond grading certificate. All the diamonds we sell in China are accompanied

by a grading certificate from the government’s National Gem Testing Center

(NGTC) diamond grading laboratory. In Hong Kong, most of our solitaire diamonds

are graded by the Gemological Institute of America (GIA).

MR: How important is the internet as a Chinese sales

channel?

KW: Ecommerce is an important channel to approach customers

and attract them to our stores. Direct sales over the internet are very limited

and the best internet activities complement and work in coordination with other

sales channels that provide the customers with a more intimate and informative

sales experience. Trust is very important in the Chinese market and the success

of our brand penetration and recognition gives us a significant advantage when

communicating over the internet.

Consumers are always concerned about the authenticity of the

jewelry and therefore, a recognized brand has a great benefit. Our brand gives

our customers 100 percent confidence in our nearly 1,600 POS in China. While

consumers are interested in obtaining a good price over the internet, their

first concern is trust and confidence in the supplier.

MR: What advice would you have for a foreign company wishing

to enter the Chinese market?

KW: China is a very fast-moving market and it is much more

sophisticated than it was ten years ago. You have to establish a well-defined

product niche that is supported by an innovative marketing strategy.

MR: Since you design and manufacture many of your own

products, can you tell us how long it takes for you to move a product from the

design stage to the retail stores?

KW: The lead time is about 30 to 50 days, depending on what

kind of products we produce. Usually, the lead time is shorter for gold and

solitaire diamond products.

MR: How long does it take for a diamond to go from rough to

the sale of a piece of diamond jewelry?

KW: It takes

about the same amount of time – 30 to 50 days.

MR: How are you marketing the Chow Tai Fook brand in China?

Is there significant difference in how you are marketing Chow Tai Fook in China

and Hong Kong?

KW: In order to

capture different customers’ needs, we have different marketing strategies in

Hong Kong and China. For instance, we partner with banks to offer promotional

activities in Hong Kong to draw more spending by tourists. In China, we

organize VIP events, such as movie premieres and travel opportunities, which

are more lifestyle driven. We also leverage on department stores’ marketing

activities to broaden our customer base.

MR: How important is the wealthy customer? Does Chow Tai Fook

sell very big diamonds and how do you market and service the very big

customers?

KW: All of our customers, regardless of whether they buy

mass luxury products for $250 to $13,000 or high-end luxury products priced

above $13,000, are important and valuable.

We see that customers in Hong Kong, including People’s

Republic of China (PRC) tourists, who have higher spending power, are more

likely to buy gem-set jewelry, including diamonds. On the Mainland, as

disposable income increases, we are seeing an increasing number of Chow Tai

Fook customers who are able and willing to buy quality diamond jewelry products

from an iconic and trusted brand like ours. Also, because we are a DTC

sightholder and a Select Diamantaire of Rio Tinto, we have an edge to be able

to offer quality diamond jewelry products that precisely meet the needs and

desires of our VIPs.

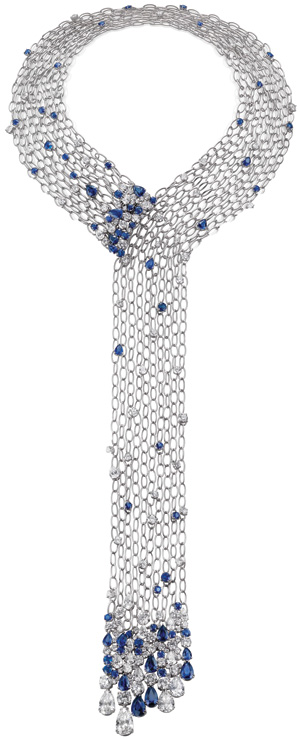

|

Platinum necklace with white diamonds and sapphires.

|

MR: How have significantly higher gold prices impacted

Chinese jewelry demand? Are people buying more or less jewelry now that gold

prices have risen to higher levels?

KW: Our jewelry sales are relatively less impacted by the

volatility and the price of the commodity. Our customer’s purchase is normally

based on his/her spending budget, which is more driven by the disposable income

level and wealth effect. When the price of gold goes up, customers generally

just choose smaller items to fit into their budgets. It is true that the sale

of diamond jewelry is growing as people are starting to consume diamond jewelry

for more diversified reasons. According to the Frost & Sullivan report,

wedding celebrations are still a strong driver of diamond consumption. Every

year, there are about 50,000 newly married couples in Hong Kong, more than 80

percent of whom will buy diamond rings, and every year, there are more than 13

million newly married couples in Mainland China. The Frost & Sullivan

research showed that 65 percent of newly married couples choose diamond rings

as their love tokens in medium- and large-size Mainland cities.

MR: Did you change your product lines due to higher gold

prices?

KW: The demand for our products is event-driven and

influenced by Chinese gift-giving customs, with the events oriented around

ceremonial and festive occasions, such as Christmas, Chinese New Year,

Valentine’s Day, weddings and newborn arrivals. The demand remains resilient in

good times and bad. Culture-driven purchases are not as sensitive to changes in

commodity prices.

We also have a centralized IT (information technology) and

CRM (customer relationship management) system that enables us to quickly understand

customers’ current shopping behavior and preferences so we can formulate more

effective marketing and product strategies.

MR: What are the top three best-selling items in your

stores? Are you developing new products specifically for Tier III and Tier IV

cities?

KW: We have a robust product mix to cater to different

images and customer needs. The products in our stores in China can be

categorized and differentiated into 4 “images”: Deluxe Style, Elegant Style,

Contemporary Style and CHOWTAIFOOK Young Zone. Given the differences in

disposable income, it is true that average sale price and ticket size are

slightly lower in lower-tier cities, however, their volume growth is much

faster than that of the Tier I cities. For instance, customers in lower-tier

cities mostly buy gold products for their first purchase, and when they become

more affluent, they buy gem-set jewelry. We also introduce different

collections that reflect customers’ unique ethnic traditions and culture, e.g.,

the “Perfect Match” collection, which is a pair of specially designed rings or

pendants, targeting young couples; our Bao Bao Family collection was also very

well received by PRC customers when we launched the initial collection.

MR: What advice would you have for a young person entering

the diamond industry?

KW: Integrity, passion and circumspection are the key traits

for young people to enter the diamond industry. We provide our employees with a

clear career path and offer them opportunities for upgrading their skills and

promotions through tailored training programs.

*All dollar figures are in U.S. dollars.

Article from the Rapaport Magazine - May 2012. To subscribe click here.