Demand for rough diamonds in the secondary market through October left many in the industry perplexed, as they weren’t seeing the same strong demand trends filtering through from further along the pipeline. While reports indicate that demand for polished diamonds and jewelry at the wholesale and retail levels remained stable, if not slightly up — driven by growth in the emerging markets of China and India — manufacturers continued to aggressively seek out rough stock.

Demand in the secondary market was evident at the Diamond Trading Company (DTC) October sight, where De Beers kept its prices stable, but premiums on DTC boxes increased and traded at an average of 10 percent. De Beers further reported strong demand for its rough diamonds at its Diamdel online auctions in the third quarter, with almost 99 percent of its goods selling at their first presentation.

“The strong demand witnessed during the first two quarters of 2010 has been sustained into the third quarter with no loss of momentum, with Belgium and Israel-based businesses continuing to demonstrate the strongest demand,” said Neil Ventura, chief executive officer (CEO) of Diamdel.

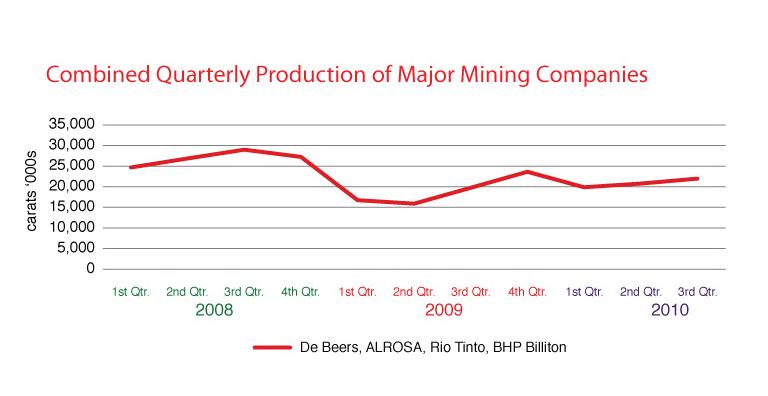

Jean-Marc Lieberherr, Rio Tinto’s marketing manager, explained that there are a number of factors stimulating the demand for rough at the moment. These factors include buoyant emerging markets in China and India and the prevailing effects of the sharp production cuts enacted during the global economic downturn (see graph below).

*De Beers, Rio Tinto and BHP Billiton data is based on those reported by the companies.

** ALROSA data based on Rapaport Estimates.

Cautious Ramp-Up

De Beers has adopted a cautious approach to ramping up output during the recovery. Production rose 15 percent year on year to 9.033 million carats in the third quarter of 2010, but those numbers were still 31 percent below 2008 levels. The worldwide recession also influenced Rio Tinto to postpone the launch of its Argyle underground development, meaning that it will mine from the lower-grade open pit for an additional two years. The result is that while Rio Tinto’s third-quarter production rose 27 percent to 3.536 million carats, it was 42 percent below 2008. Lieberherr estimates that the company will maintain annual production of between 12 million carats and 15 million carats in 2011 and 2012 before ramping up to more than 20 million carats again.

The shortfall in rough has caused manufacturers to eye other untapped sources, such as Zimbabwe’s Marange mine and Russia’s state repository Gokhran, this time without the concern of flooding the market with goods. Both Zimbabwe and Russia have given assurances in the past that they will bring their rough supply to the market based on demand and at a fair price.

Others have noted that the Zimbabwe goods may have an impact only on the lower end of the market, as the production set to come onstream is not suitable for better-quality polished. However, one Surat-based manufacturer told RDR that he has had D flawless diamonds in his Marange stock.

Polished Stability

Still, the demand for rough has not filtered to the polished market and prices have remained stable during the month. The average Rapnet Asking Price Index (RAPI) rose 0.6 percent through the month to October 26, spending most of the period in positive territory (see graph below).

* Rapaport Spec 2, Round D-H, IF-VS2, X, X-VG, GIA-HRD-AGS

For the year through October, prices have grown significantly, with average RAPI for 3-carat stones up 21 percent, 1-carat diamonds increasing 11 percent and 0.50-carat stones rising 2.6 percent from the beginning of the year (see graph below). Increases were steepest through the first six months of 2010, after which the market appears to have stabilized.

* Rapaport Spec 2, Round D-H, IF-VS2, X, X-VG, GIA-HRD-AGS

Manufacturers indicate that demand for 3-carat stones remained strong through October in all categories, while Indian demand is strong for 0.02-carat stars and melee, as well as 0.50-carat and 0.75-carat SI-and-lower piqué goods. Trading has been characterized by strong price resistance by buyers, particularly in the Far East, who have been unable to translate the rise in manufacturing costs to their end product.

Holiday Time

As is historically the case, the trade has entered the fourth quarter of the year with high hopes for the U.S. holiday season, which traditionally begins on Thanksgiving weekend. Forecasts for the season are for low single-digit growth over 2009.

However, while the U.S. holiday remains an important component of the industry’s annual turnover, this year, more emphasis is being placed on other markets and other holidays than in previous years. India’s Diwali season, which starts November 5, is one of them. Mehul Choksi, chairman of Gitanjali Group, India’s largest jewelry retailer, estimates that Diwali accounts for about 20 percent of annual jewelry sales in India.

Similarly, the diamond industry is paying more attention to China’s Golden Week in October and the Chinese New Year in February, hoping their sales will offset some of the slump in the West.

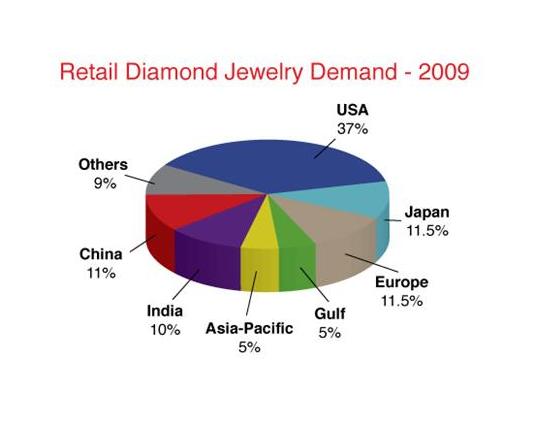

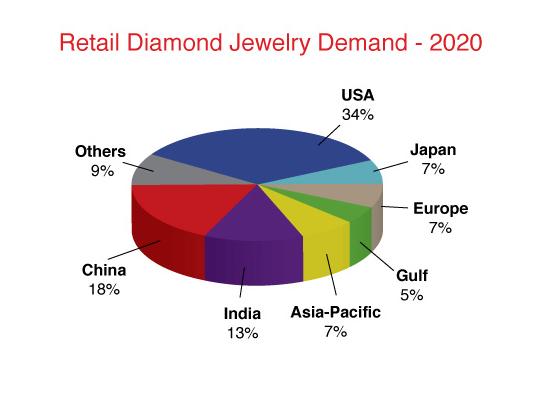

While the U.S. is expected to maintain its position as the largest single consumer market for diamond jewelry, the worldwide recession highlighted the opportunities in emerging markets, casting them as the growth markets during the next decade. Rio Tinto offers the most optimistic forecast for growth in China and India, saying these two markets combined will account for 40 percent of the market by 2020, outsizing the U.S. (see graphs below).

* Rapaport Estimates

Stable Markets

Tapping these opportunities is feeding some optimism to the market, which has become apparent in the run-up to the Christmas season. This, combined with the return of U.S. retailers who are still replenishing stocks depleted in 2009, as well as buying to fulfill new orders, has resulted in an overall stable environment for the industry.

As a result, many diamantaires seem satisfied with the progress made in 2010, albeit with some degree of caution for the prospects of economic recovery in the U.S. and Europe. However, no one is expecting a boom. As one Israeli manufacturer said, “I expect the U.S. will be flat over Christmas, nothing more. But it largely depends on the stock market.”

Rather, the industry is hoping the recent stability will encourage miners to bring more rough onto the market come 2011 and convince more retailers to raise their offers for polished.

Even if the market has not fully recovered, it appears far more confident and optimistic than it was a year ago. At least for now, the discussion has clearly shifted away from the recession-recovery question toward how best to capitalize on the opportunities that today present themselves.

Article from the Rapaport Magazine - November 2010. To subscribe click here.