The diamond market was positive in June as strong consumer sentiment in the US and China buoyed expectations for polished demand. The Las Vegas trade shows at the start of the month were slow, but that’s partly because companies are finding cheaper ways of doing business, such as e-commerce.

Traders are worried about access to credit, especially in India and Belgium, where banks are increasingly wary of financing the industry. In addition, De Beers’ launch of a fashion-jewelry line featuring laboratory-grown diamonds has created concerns about future demand for lower-quality natural stones.

Solid prices

Even so, polished-diamond prices were firm in June, especially for triple-Ex stones with no fluorescence. Shortages of diamonds weighing 3 carats or more supported prices in that size category. Traders also noted improved demand for SI-clarity diamonds.

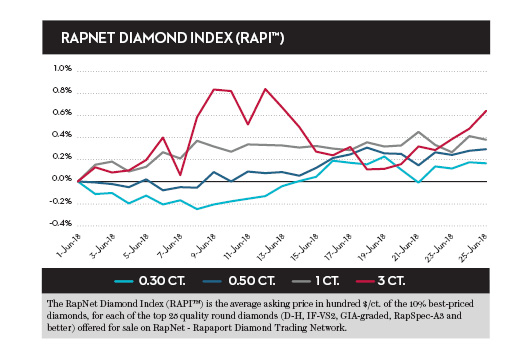

The RapNet Diamond Index (RAPI™) for 1-carat diamonds increased 0.4% between June 1 and press time on June 25. RAPI for 0.30-carat stones climbed 0.2%, while 0.50-carat prices rose 0.3%. The index for 3-carat diamonds was up 0.6% for the period.

Rough trading reflected the positive polished market, with De Beers selling $575 million of goods in June. Demand was especially strong in the 1-carat-plus range, with prices stable or slightly up, while average premiums on the secondary market were between 3% and 6%, according to sightholders. Alrosa increased prices in certain categories at its June contract sale due to the strong demand.

“Sentiment in the diamond industry’s midstream is positive following the JCK Las Vegas trade show at the start of the month, and we continued to see good demand for our rough diamonds across the product range,” said De Beers CEO Bruce Cleaver.

Consumer confidence on the rise

US retail demand was strong as well. Consumer confidence rose modestly in early June, according to research by the University of Michigan. US sales of diamond jewelry increased 5% in North America in the first quarter, and jumped 11% in the Asia-Pacific region, Alrosa reported.

Greater China has seen a significant improvement in consumer demand after the slump of 2015 and 2016. Sales of gold, silver and jewelry in China rose 7.5% to $14.32 billion (CNY 93.9 billion) in the January-to-May period, according to the country’s National Bureau of Statistics.

Hong Kong retailers also reported hefty increases in revenues and profits, with Luk Fook’s sales up 14% to $1.86 billion (HKD 14.58 billion) for the fiscal year ending March 31. Total sales of jewelry, watches, clocks and other valuable items in Hong Kong jumped 25% to $843.6 million (HKD 6.62 billion) in April, and increased 23% to $3.78 billion (HKD 29.62 billion) in the first four months, according to Hong Kong’s Census and Statistics Department.

The conditions present reasons for hope as traders prepare inventories ahead of the important holiday season.

Article from the Rapaport Magazine - July 2018. To subscribe click here.